Nourishing Hope with your legacy

Charitable Remainder Annuity Trust

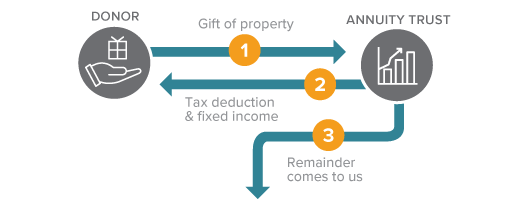

How It Works

- You transfer cash, securities, or other appreciated property into a trust. The required minimum for this type of gift is $100,000.

- The trust makes fixed annual payments to you or to beneficiaries you name.

- When the trust terminates, the remainder passes to Nourishing Hope to be used as you have directed.

Benefits

- Receive income for life or a term of years in return for your gift.

- Receive an immediate income tax deduction for a portion of your contribution.

- Pay no up front capital gains tax on appreciated assets you donate.

- Use the trust to meet needs that are tied to a specific time frame, such as college tuition payments.

Next

- Frequently asked questions on Charitable Remainder Annuity Trusts.

- Related Gift: Charitable Remainder Unitrust.

- Contact us so we can assist you through every step.

Nourishing Hope Exists Because of the Support of Our Neighbors.

Providing the equivalent of 4.5 million meals each year, plus thousands of mental wellness and social services that empower healthy lives, Nourishing Hope strives to create a city where all people have the resources needed for a dignified life. Join us today!